Retail Location Intelligence

Get granular. Get local. Win share.

Retail location intelligence turns transaction data into a competitive edge. Whether you’re opening stores, monitoring trade areas, or powering spatial analytics, Facteus delivers store-level sales across 5M+ U.S. locations so you can act with confidence.

Clients & Partner types

Unmatched Speed

Shopping mall owners

Predictive

Retailers and restaurants

Massive

Retail Advisory firms

Row-Level

Local and state governments

Row-Level

Location analytics SaaS companies

Row-Level

Point of Interest service providers

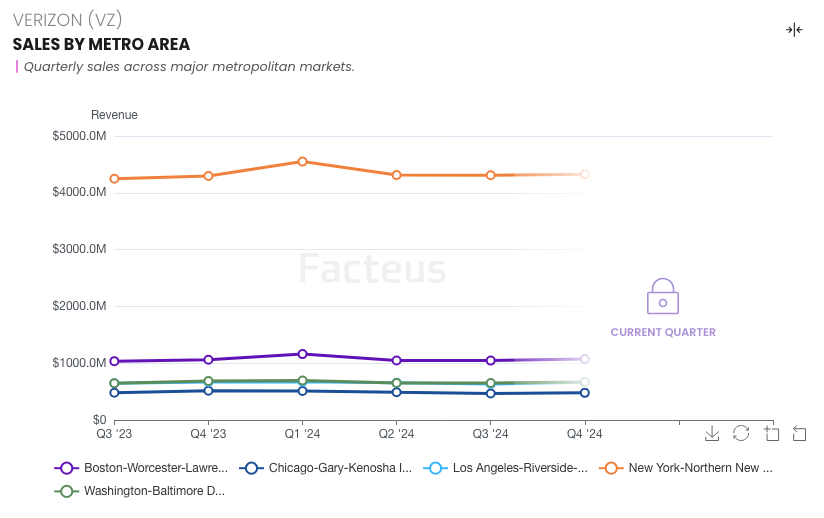

Track Shopping Behavior with Local Precision

- See spend trends by store, ZIP code, city, or region—updated daily

- Detect demand surges and seasonal shifts before competitors do

- Spot changes in shopper frequency, basket size, and visit patterns

- Monitor where your customers go next when they stop visiting

- Understand local anomalies that get lost in national rollups

Benchmark Store Performance & Competitive Sales

- Compare your store’s sales to specific competitors across local trade areas

- Identify over- and under-performing locations in near real-time

- Track shifts in market share across regions or categories

- Quantify the impact of competitor openings or closures near your stores

- Map saturation zones to avoid cannibalization or missed opportunities

Power Smarter Platforms with Real-World Sales

- Enrich POI or location intelligence platforms with true transaction volume

- Layer in sales alongside mobility, demographic, and behavioral data

- Support product development for GIS, urban planning, and analytics tools

- Integrate clean, anonymized feeds into SaaS platforms or client deliverables

- Enable predictive models that reflect actual consumer spend—not just proxies

Fuel Economic Development with Real Retail Vitality

- Give cities, states, and agencies a clear view of retail health by trade area

- Support grant-making, zoning, and revitalization efforts with hard data

- Identify underserved retail zones for development or incentive programs

- Provide data-driven justification for infrastructure or public service shifts

- Benchmark economic recovery or distress signals across geographies

Optimize Store Portfolios and Trade Area Strategies

- Identify which stores are lagging vs. peers in the same trade zone

- Detect trade area shifts caused by new competitors or consumer migration

- Tie performance to local dynamics, not just internal metrics

Pick the Right Markets Before Competitors Do

- Rank ZIPs and regions based on real sales opportunity, not just models

- Target high-demand areas with low saturation for new store openings

- Avoid overbuilt markets by understanding local spend density

- Use transaction data to validate or disprove modeled location assumptions

- Accelerate site selection workflows with location-ready intelligence

Prove Impact of Local Promotions and Campaigns

This is the heading

Measure lift from regional ads, offers, and sponsorships by ZIP

This is the heading

Track share shifts during and after localized marketing efforts

This is the heading

Compare performance to control markets with no media spend

This is the heading

Shorten the feedback loop between activation and optimization

This is the heading

Attribute spend changes to specific campaigns with clean pre/post data

Flexible Data Access Options

- API – developer friendly access points

- Easily append your existing point of interest data with actual sales and transaction information

Example Data Append: